From Wallet to Walletless

I still remember the first time I scanned a QR code at my neighborhood kirana shop and paid ₹100 in under 5 seconds — faster than digging into my bag for change. That moment felt almost futuristic. But today, millions of Indians pay like this: seamlessly, instantly, often for amounts far smaller than ₹100.

What changed in between was not magic, but infrastructure. The shift from cash to digital payments is real and sweeping. With real-time payments, money moves instantly; no bank-holiday delays, no long forms, no friction. And India doesn’t just participate — it leads.

In this article, I explore how India’s journey to becoming the world’s real-time payment champion unfolded: the design decisions, socio-economic push, and lessons that turned UPI into a global benchmark. You’ll learn what worked — and what we can all take away from it.

What Are Real-Time Payments — And Why They Matter

“Real-time payments” refer to systems where money transfers (peer-to-peer, consumer to merchant, or merchant to merchant) happen instantly — funds move and settle in seconds, 24×7×365, regardless of bank or holiday.

In many countries, payments remained a bit slow — delayed by batch processing, banking hours, or inter-bank clearance protocols. For a large, fast-growing economy like India, that delay was a drag.

Enter National Payments Corporation of India (NPCI), which in April 2016 launched UPI — a system designed to let any bank customer send/receive money via a simple mobile app, with only a UPI ID or QR code, bypassing legacy constraints.

Over the years, UPI grew beyond convenience; it became the backbone of digital finance — enabling merchants, small shops, gig workers, migrants, even rural economies — to transact with ease.

The Rise of UPI: Data, Scale & Momentum

- Explosive growth: According to NPCI, by October 2025 there were 683 banks live on UPI. The monthly transaction volume hit 20.7 billion in October 2025, marking a new record.

- Transaction value rising fast: In June 2025, UPI processed payments worth ₹24.03 lakh crore.

- Ubiquity across users & merchants: UPI serves 491 million individuals and 65 million merchants, connecting 675 banks on a single interoperable platform.

- Dominance of retail digital payments: UPI now accounts for 85% of all digital transactions in India.

- Global real-time payments lead: As of 2023, India processed nearly 130 billion real-time payments, amounting to 49% of all real-time transactions worldwide — more than the next 10 markets combined.

In short: a tool that began as a convenience feature became a backbone of India’s digital economy.

Real-World Examples & Case Studies

From Metro to Village: Small Merchants Going Digital

A friend of mine runs a small tea stall in a semi-urban town. A few years ago, he accepted only cash. Today, he uses UPI: customers scan a QR code on their phone, and the money arrives in seconds. No change, no ledger — just instant confirmation.

This shift is echoed across millions of small shops, roadside vendors, salons, tuition centres — paving a way for financial inclusivity even where digital or banking literacy was initially low. UPI’s interoperable design (works across banks and apps) meant there was no barrier for merchants or customers.

Big League: Giants, Festivals & Peak Demands

In October 2025, during the festive shopping rush, UPI recorded 20.7 billion transactions in just one month.

From buying groceries to paying utility bills, booking travel, or ordering food — the convenience and speed made UPI the default mode for many. No queue, no cash, no waiting.

Cross-Border & Global Reach

UPI’s success has started transcending borders. As of 2025, UPI is live in several countries — including UAE, Singapore, Bhutan, Nepal, Sri Lanka, France and Mauritius.

For the Indian diaspora, this offers a familiar, low-friction way to send money or make payments abroad — and hints at how UPI’s model could influence digital payments globally.

What UPI Taught Me — Personal Lessons & Observations

As someone who grew up in a small town and later moved to a big city, I have seen both sides — cash-led, informal payments, and digital-first urban life. UPI blurred that divide. It made everyday payments uniformly easy, for the tea stall-owner in a village and the tech-savvy professional in a metro.

What surprised me most: the attitude shift. People began to view digital transfers as more trustworthy than cash — because of clarity (instant confirmation), convenience (no change, no coins), and speed (real-time). Even older relatives — once wary of “online payments” — started embracing UPI.

It taught me that technology only unlocks potential when it’s inclusive, intuitive, and interoperable — and when it’s built for everyone, not just the urban digital elite.

Why India’s UPI Model Worked - Key Insights

Open, Interoperable & Bank-Agnostic

Unlike closed wallets/app-specific systems, UPI works across banks and apps. That meant I could use one UPI ID regardless of whether I banked with Bank A or Bank B — and receive payments from someone using a different banking app. This openness created network effects: more users meant more value, encouraging even more adoption.

Low Cost & High Accessibility

Payments cost little or nothing. Merchants (even small ones) don’t need expensive POS terminals — just a QR code and a smartphone (or increasingly, even simpler phones with feature-phone solutions).

Mobile + Banking + Internet ++ Financial Inclusion Policies

India’s massive banking drive (for example, via earlier schemes that pushed for wider bank account adoption), cheap internet, growing smartphone penetration — all aligned at once. That created fertile ground for UPI.

Government & Institutional Backing — Stability & Trust

Developed by NPCI (under oversight of central banking and banking associations), UPI had regulatory backing and stability from the start. That helped build trust among users, merchants, and banks.

Built for Everyday India — Small Amounts, High Frequency

Because UPI is optimized for high-frequency, low-ticket transactions (like daily groceries, commuting, bills) rather than just big transfers, it fit everyday Indian needs — making digital payments the default rather than exception.

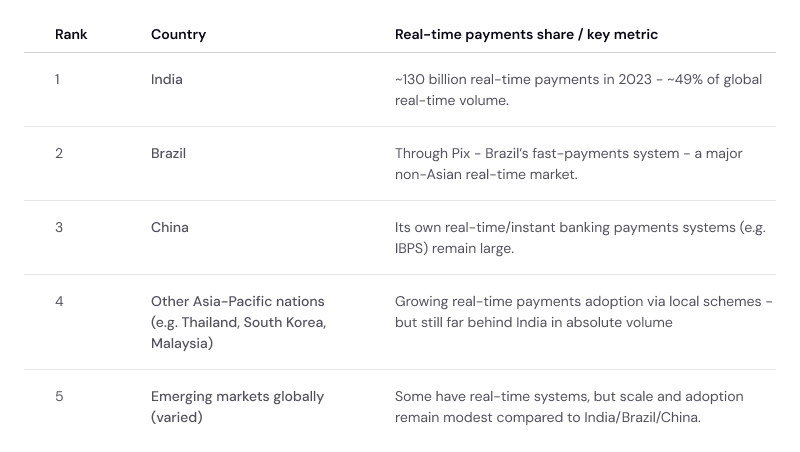

Country Comparison: Top 5 Real-Time Payment Markets (by Volume)

Note: precise ranking varies by data source - but every global instant-payment snapshot consistently places India at the top by volume and ubiquity.

What India’s Real-Time Success Means for the Future

India’s leap from wallets to UPI-led real-time payments shows how thoughtful digital infrastructure can redefine everyday life. It’s not just about technology — it’s about trust, accessibility, and enabling millions to transact seamlessly.

For other countries, developers, fintech startups — it’s a blueprint. Design for universality, prioritize inclusion, reduce friction, and build interoperable systems.